- Mon - Sat: 8 AM to 6 PM

- Golf Course Extension Road, Gurugram - 122018

- +91-7428764445

Public Limited Company

- Home

- Business Registration

- Public Limited Company

Services

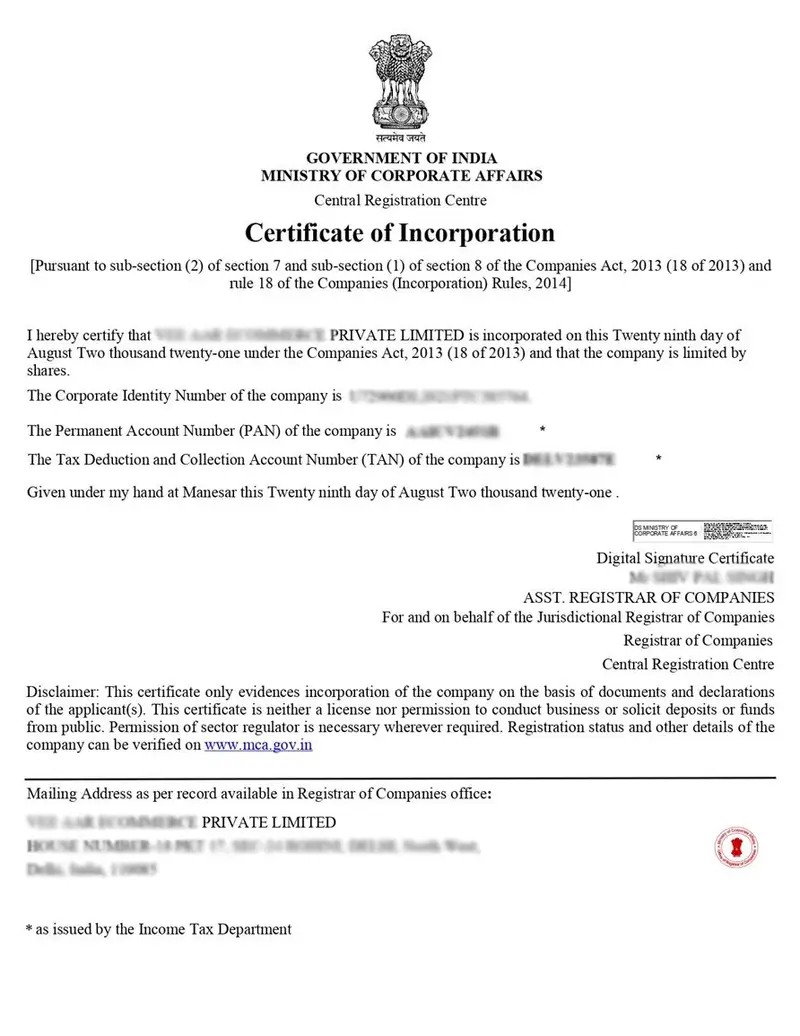

Sample Certificate

PACKAGES

Private Limited Company

@ 9999/-

Private Limited Company

@ 9999/-

Private Limited Company

@ 9999/-

Private Limited Company

@ 9999/-

Private Limited Company

@ 9999/-

Private Limited Company

@ 9999/-

Private Limited Company

@ 9999/-

Private Limited Company

@ 9999/-

Private Limited Company

@ 9999/-

Public Limited Company - An Overview

A Public Limited Company in India is best for the business which has proposed its operations at Large scale. It has got all the features of Public Limited Company along with various other features viz No Limit on Maximum number of shareholders , Raising of Funds from General Public, Transferability of shares that too with the limited liability .

Only Public Limited Companies are allowed to get their shares listed on stock exchange in compliance with various laws and Provisions and Stock Exchange.

Public Limited Company has its Provisions in Section 2(76) of Companies act, 2013. Regardless to say most of the big companies in India are registered as Public Limited Company.

Public Limited Company Package Includes

Process of Registering Public Limited Company

Filing for Name Approval

After the submission of documents to the Legalite, we apply 2 names to Ministry of Corporate Affairs vide www.mca.gov.in on behalf of our clients along with the requisite fees. Name Approval Generally takes 24-48 Hours Excluding Holidays.

Application of DIN and DSC

The application of Director Identification number and Digital Signature is made as soon as the name is approved by MCA. The above application and completion generally takes 24-48 hours.

Framing of MOA and AOA and Submission

The MOA and AOA is drafted through the expert (CA/CS) as per the requirement of the Client, since the MOA contains the Object of the Company / Purpose for which the company is registered, Client’s involvement is required for accomplishment of the same. After the Drafting the application is finally made to the Department along with the attached DSCs of Subscribers/Directors and Professional (CA/CS/CMA)

Issuance of COI, E-Pan, E-Tan, ESIC and EPFO Registration

If the Department is satisfied with the Documents submitted and is of view that the Information given are in order and Documents are in order, it issues the Certificate of Incorporation Followed by E-Pan, E-Tan, ESIC and EPFO Registration.

Requirements for Registration

- A minimum of 7 shareholders and 3 Directors who can be same person.

- One of the Directors must be resident in India.

- Director Identification number (DIN) of all the Directors and shareholders are required.

- Digital Signature certificate (DSCs) of all the Directors and shareholders are required.

Note: Company planning to incorporate in any specific Government regulated sectors are required to take Prior Approval of the Department before Registering the Company.

DOCUMENTS REQUIRED

For Directors / Shareholders

- Passport Size Coloured photograph.

- Aadhaar Card and Pan Card (Self Attested).

- Email Id and Mobile number.

Telephone / Gas Bill/Electricity bill/ Bank Statement (Not exceeding 60 Days). - Passport/ Voter ID, Driving License.

For Registered office Proof

- Proof of Premise: Electricity Bill/Telephone Bill/water Bill.

- No objection Certificate (NOC) From Owner of Premise.

Benefits of Registering Public Limited Company

-

Raising Capital through General Public

-

Brand Building and better Image of the Entity

- Funds and Investments are easily available

-

Can be listed on Stock Exchange.

-

Trading of shares is also possible.

-

Growth is considered is to be phenomenal

General Queries

How may I apply the name of the Public Limited Company in India?

Two names in order of Priority can be applied at once on www.mca.gov.in website. Although all the rules pertaining to Rule 8 – Companies (Incorporation) Rules, 2014. The Uniqueness of name is also an important factor to be kept in mind while applying name of company. The Name Approval normally takes 24-48 hours from the time of application excluding holidays.

How May I check whether the name we are proposing Exists or Not?

Before deciding the name the factors such as uniqueness and Rule 8 – Companies (Incorporation) Rules, 2014 must be borne in mind, in order to check the name on www.mca.gov.in following steps are to be followed:

- Visit on www.mca.gov.in

- Click on MCA Services

- Click on Company Services and Check Company Name

Is Physical Documents of Documents are required for Company Registration as my proposed registered office is in Bangalore?

No, there is no need of submitting any Physical copy of Documents as the process is entirely online. No physical Involvement is required at any point of time.

I am a working Men/Woman employed in another company, May I incorporate the Public Limited Company?

There is no such specific restriction as far as the Companies Act, 2013 is concerned rest Terms and Conditions or Job offer letter may be referred for any such restriction from your Employer. Many Companies put restrictions pertaining to carrying on company while working in the company.

As minimum Two Directors/ Shareholders are required for Incorporating the company, May my Brother, Father or Mother act as the second Director/ Shareholder?

Yes, your Brother, Father, Mother or any relative may act as the second Director/ Shareholder.

Is PF, ESI and GST is automatically applicable to Public Limited Company?

No, Applicability of all above is entirely based on the threshold limit set by the Government in that regard. Relevant act may be referred for specific provisioning.

May we change the address of Company after Registration?

Yes, the address of Company may be changed after the registration following the secretarial compliance post registration.

Will I have to deposit the amount of capital in Bank account?

Yes, you are supposed to deposit the sum equivalent to the shares subscribed during incorporation in the company’s Bank account opened after the Registration.

Is the Company required to appoint auditor after the registration?

Yes, the appointment of auditor who is Practising chartered Accountant in Practice is required to be done within 30 Days from the date of Incorporation and form ADT-1 is required to be filed within 15 days from the expiry of 30 days.